Hillary Clinton has made clear she intends to dramatically raise taxes on the American people if elected. She has proposed an income tax increase, a business tax increase, a death tax increase, a capital gains tax increase, a tax on stock trading, an “Exit Tax” and more (see below). Her planned net tax increase on the American people is at least $1 trillion over ten years, based on her campaign’s own figures.

Hillary Clinton has made clear she intends to dramatically raise taxes on the American people if elected. She has proposed an income tax increase, a business tax increase, a death tax increase, a capital gains tax increase, a tax on stock trading, an “Exit Tax” and more (see below). Her planned net tax increase on the American people is at least $1 trillion over ten years, based on her campaign’s own figures.

Hillary has endorsed several tax increases on middle income Americans, despite her pledge not to raise taxes on any American making less than $250,000. She has said she would be fine with a payroll tax hike on all Americans, she has endorsed a steep soda tax, endorsed a 25% national gun tax, and most recently, her campaign manager John Podesta said she would be open to a carbon tax. It’s no wonder that when asked by ABC’s George Stephanopoulos if her pledge was a “rock-solid” promise, she slipped and said the pledge was merely a “goal.” In other words, she’s going to raise taxes on middle income Americans.

Hillary’s formally proposed $1 trillion net tax increase consists of the following:

Hillary’s formally proposed $1 trillion net tax increase consists of the following:

Income Tax Increase – $350 Billion: Clinton has proposed a $350 billion income tax hike in the form of a 28 percent cap on itemized deductions.

Business Tax Increase — $275 Billion: Clinton has called for a tax hike of at least $275 billion through undefined business tax reform, as described in a Clinton campaign document.

“Fairness” Tax Increase — $400 Billion: According to her published plan, Clinton has called for a tax increase of “between $400 and $500 billion” by “restoring basic fairness to our tax code.” These proposals include a “fair share surcharge,” the taxing of carried interest capital gains as ordinary income, and a hike in the Death Tax.

But there are even more Clinton tax hike proposals not included in the tally above. Her campaign has failed to release specific details for many of her proposals. The true Clinton net tax hike figure is likely much higher than $1 trillion.

For instance:

Capital Gains Tax Increase — Clinton has proposed an increase in the capital gains tax to counter the “tyranny of today’s earnings report.” Her plan calls for a byzantine capital gains tax regime with six rates. Her campaign has not put a dollar amount on this tax increase.

Tax on Stock Trading — Clinton has proposed a new tax on stock trading. Costs associated with this new tax will be borne by millions of American families that hold 401(k)s, IRAs and other savings accounts. The tax increase would only further burden markets by discouraging trading and investment. Again, no dollar figure for this tax hike has been released by the Clinton campaign.

“Exit Tax” – Rather than reduce the extremely high, uncompetitive corporate tax rate, Clinton has proposed a series of measures aimed at inversions including an “exit tax” on income earned overseas. The term “exit tax” is used by the campaign itself. Her campaign document describing this proposal says it will raise $80 billion in tax revenue, but claims some of the $80 billion will be plowed into tax relief. How much? The campaign doesn’t say.

This proposal completely fails to address the underlying causes behind inversions: The U.S. 39% corporate tax rate (35% federal rate plus an average state rate of 4%) and our “worldwide” system of taxation, which imposes tax on all American earnings worldwide. The average corporate rate in the developed world is 25%. Thirty-one of thirty-four developed countries have cut their corporate tax rate since 2000. The U.S. has not. Hillary’s plan moves in the wrong direction.

ATR is tracking Clinton’s full tax record at its dedicated website, HighTaxHillary.com

See also: “Everyman” Tim Kaine Tried to Raise Taxes on Adult Beverages

Hillary Opens the Door to a Carbon Tax

Hillary’s Soda Tax Endorsement Violates Middle Class Tax Pledge

Video Shows Hillary’s 25% Gun Tax Endorsement

Democrat Platform Calls for Carbon Tax

Tim Kaine Pushed Income Tax Hikes on Working Families Making As Little as $17,000

Anyone who votes Democratic/progressive/communist is voting against self, their quality of life, their family, the future of their children and freedom. They are voting for their demise and that of America.

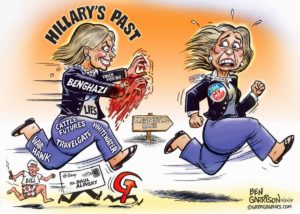

Hillary and Obama are in it together… covering up for one another as they lie, li

Hillary and Obama are in it together… covering up for one another as they lie, li e, lie, sell America out and commit treasonous acts for their progressive/communist agenda to insert American into the NWO under the rule of the UN. Hillary will continue the Obama destruction. She will put the nails in America’s coffin as she gains more power and wealth for her family. They are all lying, murdering, anti-America criminals of the highest order. Obama and Hillary should both be in Prison. They are operating as if America is a dictatorship.

e, lie, sell America out and commit treasonous acts for their progressive/communist agenda to insert American into the NWO under the rule of the UN. Hillary will continue the Obama destruction. She will put the nails in America’s coffin as she gains more power and wealth for her family. They are all lying, murdering, anti-America criminals of the highest order. Obama and Hillary should both be in Prison. They are operating as if America is a dictatorship.